Category: Bookkeeping

-

Financial Habits That Hold Back Small Business Owners – And How to Fix Them

Are bad money habits holding back your business? From mixing finances to poor record-keeping, discover the most common financial mistakes small business owners make — and the practical steps you can take to fix them.

-

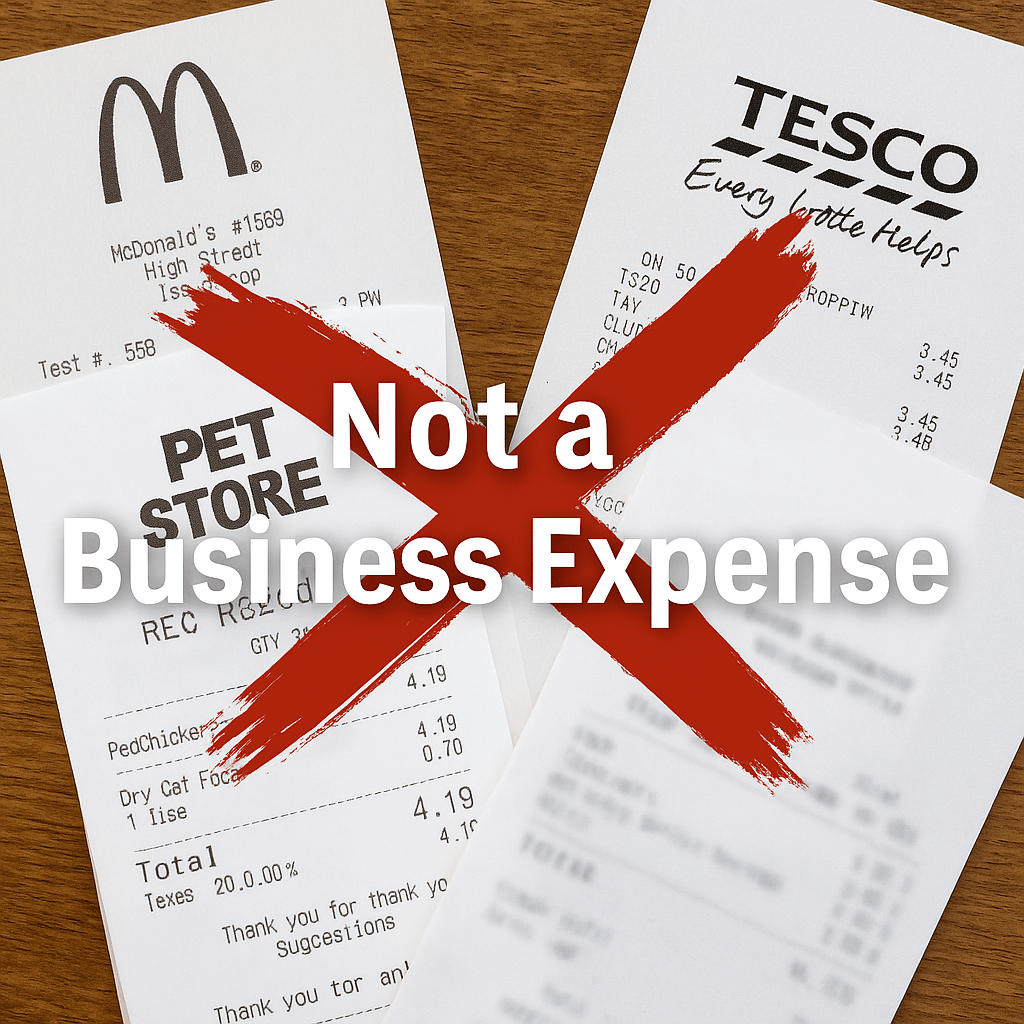

Not an Expense: Common Things Self-Employed People Try to Claim (That HMRC Will Reject)

Think you can claim McDonald’s, pet food, or your weekly shop as a business expense? HMRC says otherwise. Here’s what self-employed people get wrong — and what you really can’t claim.

-

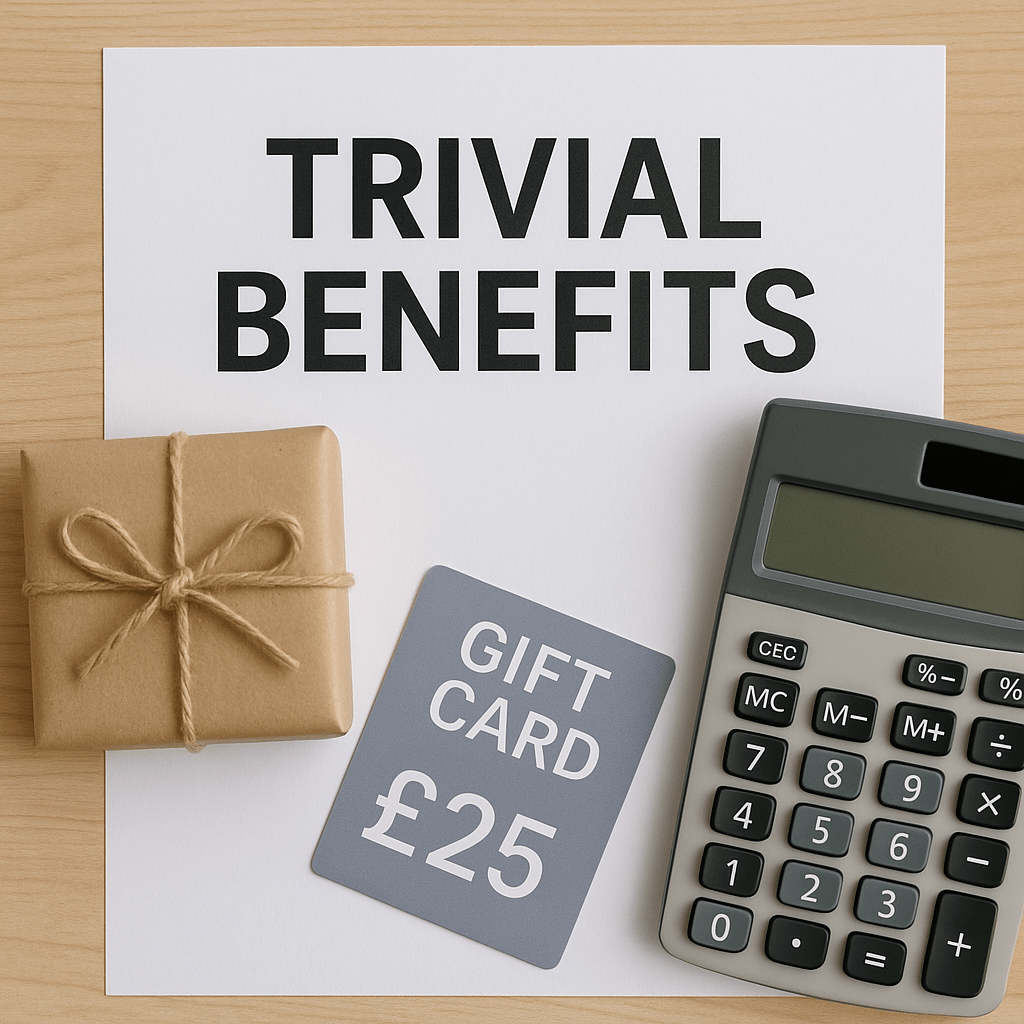

Trivial Benefits & Staff Gifts – What You Can (and Can’t) Give Tax-Free

Find out what HMRC allows as a tax-free gift under the Trivial Benefits rules. Learn the £50 limit, director restrictions, common mistakes, and how to avoid unexpected tax charges.

-

How Foreign Income Is Taxed in the UK: A Guide for Residents

If you’re a UK resident earning income from abroad — dividends, rental, trading, or foreign gains — you may need to declare it to HMRC. This guide explains how UK tax rules apply and how to avoid paying tax twice using double taxation relief.

-

Making Tax Digital: A beginner’s Guide for the Self Employed

New to MTD? This blog explains what Making Tax Digital is, how it works, and how to get started — in plain English for self-employed and landlords.

-

Business Expenses – What You Can and Can’t Claim (UK 2025)

Confused about what business expenses you can claim in 2025? This guide breaks down HMRC rules for UK sole traders and limited companies, with tips to avoid common mistakes.

-

Making Tax Digital (MTD) for Income Tax: Your Step by Step Guide for 2026

MTD for Income Tax is on its way. From April 2026, self-employed people and landlords earning over £50k must report quarterly using software. This guide explains who’s affected, how it works, and what you should do now

-

Surviving an HMRC Audit: What Triggers Investigations and How to Prepare

Worried about a potential HMRC audit? Learn what triggers an investigation, how to stay off HMRC’s radar, and what to do if you get that dreaded letter.

-

Making Tax Digital for the Self-Employed: April 2026 Changes That You Need to Know

Making Tax Digital (MTD) is evolving again. From April 2026, even more Self-employed people and Landlords will be required to keep digital records and submit quarterly updates. Here’s what you need to know to stay compliant.