Category: News & Updates

-

Making Tax Digital (MTD) for Income Tax: Your Step by Step Guide for 2026

MTD for Income Tax is on its way. From April 2026, self-employed people and landlords earning over £50k must report quarterly using software. This guide explains who’s affected, how it works, and what you should do now

-

New Companies House ID Verification Rules Coming Autumn 2025 – What You Need to Know

From Autumn 2025, company directors, PSCs, and agents must verify their ID with Companies House. Learn who must comply, how to verify, and what happens if you don’t.

-

About Me

From a childhood bakery in Zambia to founding a modern UK accountancy firm, Dora Ngoma shares the story behind Grace Certified Accountants — and why people come first.

-

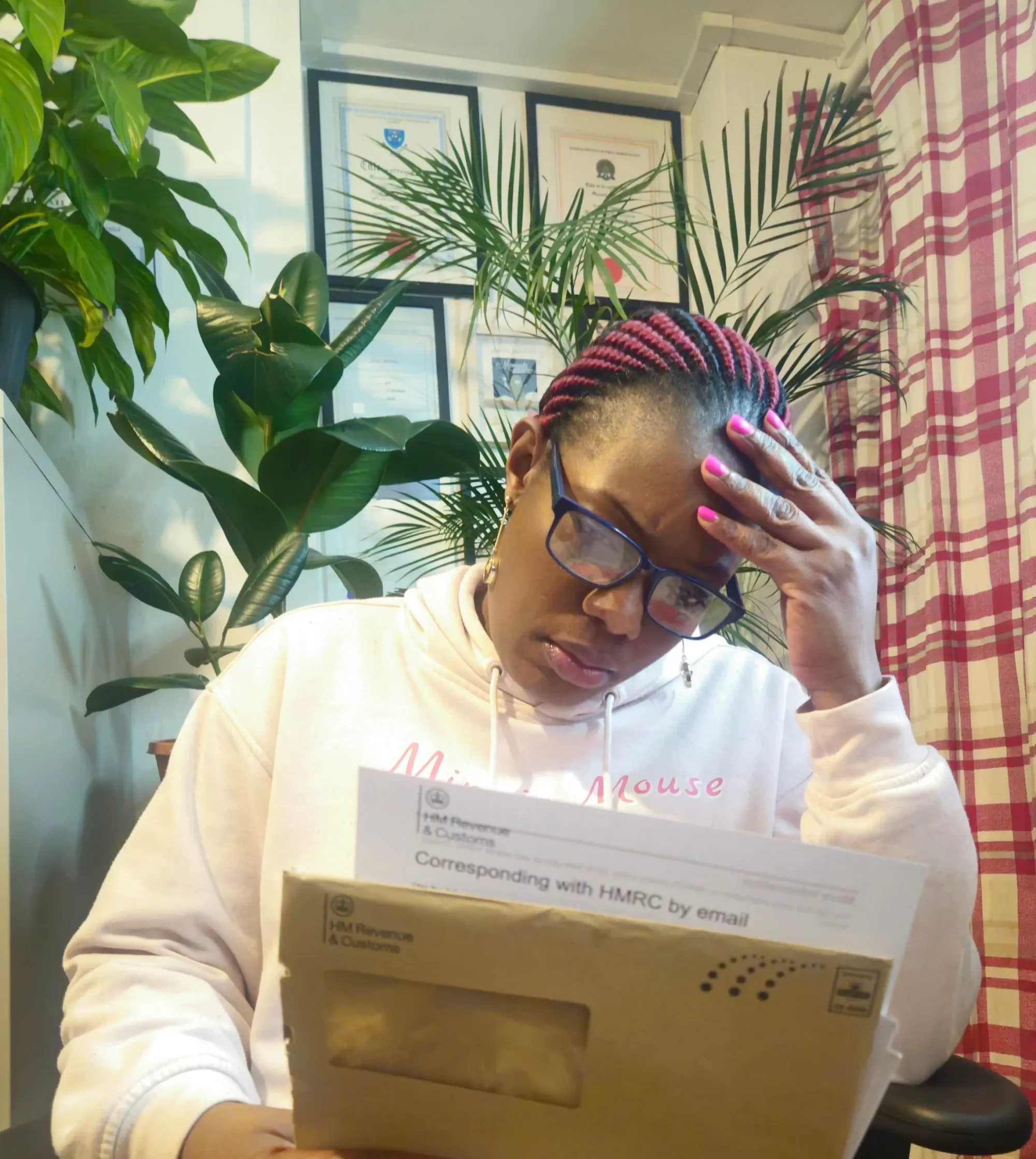

Surviving an HMRC Audit: What Triggers Investigations and How to Prepare

Worried about a potential HMRC audit? Learn what triggers an investigation, how to stay off HMRC’s radar, and what to do if you get that dreaded letter.

-

Making Tax Digital for the Self-Employed: April 2026 Changes That You Need to Know

Making Tax Digital (MTD) is evolving again. From April 2026, even more Self-employed people and Landlords will be required to keep digital records and submit quarterly updates. Here’s what you need to know to stay compliant.

-

Engaging With the Next Generation at a School Careers Day

Both as an individual and as a Business owner, I try to engage with the community as much as possible. This ranges from charities to work with my church — and, when I was asked to speak at a school careers day for sixth formers, I jumped at the chance. Adeyfield Academy is a comprehensive…

-

Welcome to our New Website

Welcome to the new online home of Grace Certified Accountants. We’re here to make accounting simpler, clearer, and more personal for you and your business. Explore our resources and get in touch to see how we can help.