Category: Self-Employed Advice

-

Financial Habits That Hold Back Small Business Owners – And How to Fix Them

Are bad money habits holding back your business? From mixing finances to poor record-keeping, discover the most common financial mistakes small business owners make — and the practical steps you can take to fix them.

-

How Do You Pay Yourself When Your Business Is a Limited Company?

Running a UK limited company? Discover how to pay yourself legally and tax-efficiently in 2025 — from salaries and dividends to director’s loans and expenses.

-

Do You Really Need an Accountant? What UK Business Owners Should Know

Not sure if you need an accountant? This guide explains when DIY is fine — and when hiring a professional will save you time, money, and stress.

-

Top 5 Tax Mistakes UK Business Owners Make (and How to Avoid Them)

Avoid these 5 common tax mistakes UK business owners make. Learn how to stay compliant, save money, and avoid HMRC penalties in this quick guide.

-

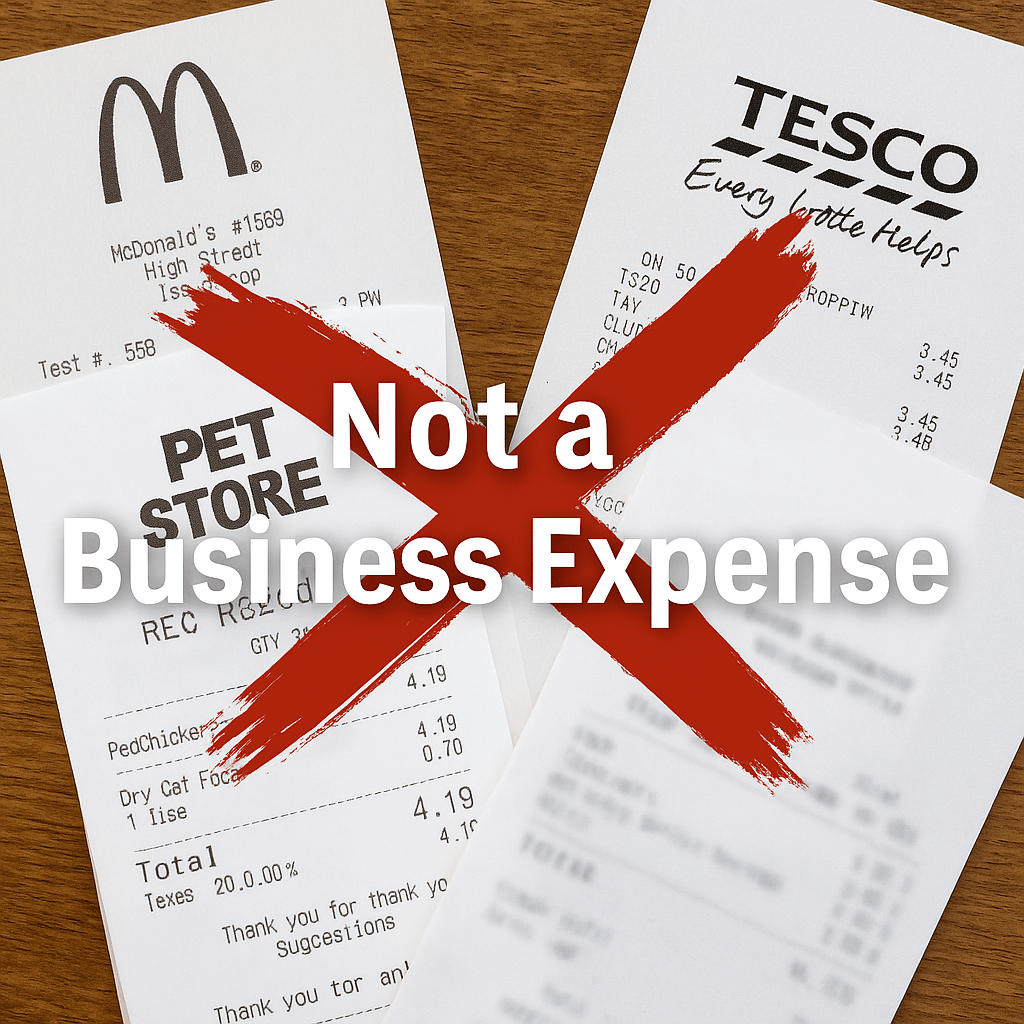

Not an Expense: Common Things Self-Employed People Try to Claim (That HMRC Will Reject)

Think you can claim McDonald’s, pet food, or your weekly shop as a business expense? HMRC says otherwise. Here’s what self-employed people get wrong — and what you really can’t claim.

-

Trivial Benefits & Staff Gifts – What You Can (and Can’t) Give Tax-Free

Find out what HMRC allows as a tax-free gift under the Trivial Benefits rules. Learn the £50 limit, director restrictions, common mistakes, and how to avoid unexpected tax charges.

-

Business Expenses – What You Can and Can’t Claim (UK 2025)

Confused about what business expenses you can claim in 2025? This guide breaks down HMRC rules for UK sole traders and limited companies, with tips to avoid common mistakes.

-

From the Village to the Boardroom: Why Every Business Needs a Support Network

Growing a business isn’t a solo act. From VAs to accountants, this post explores the power of building your own village — and why no business owner should go it alone

-

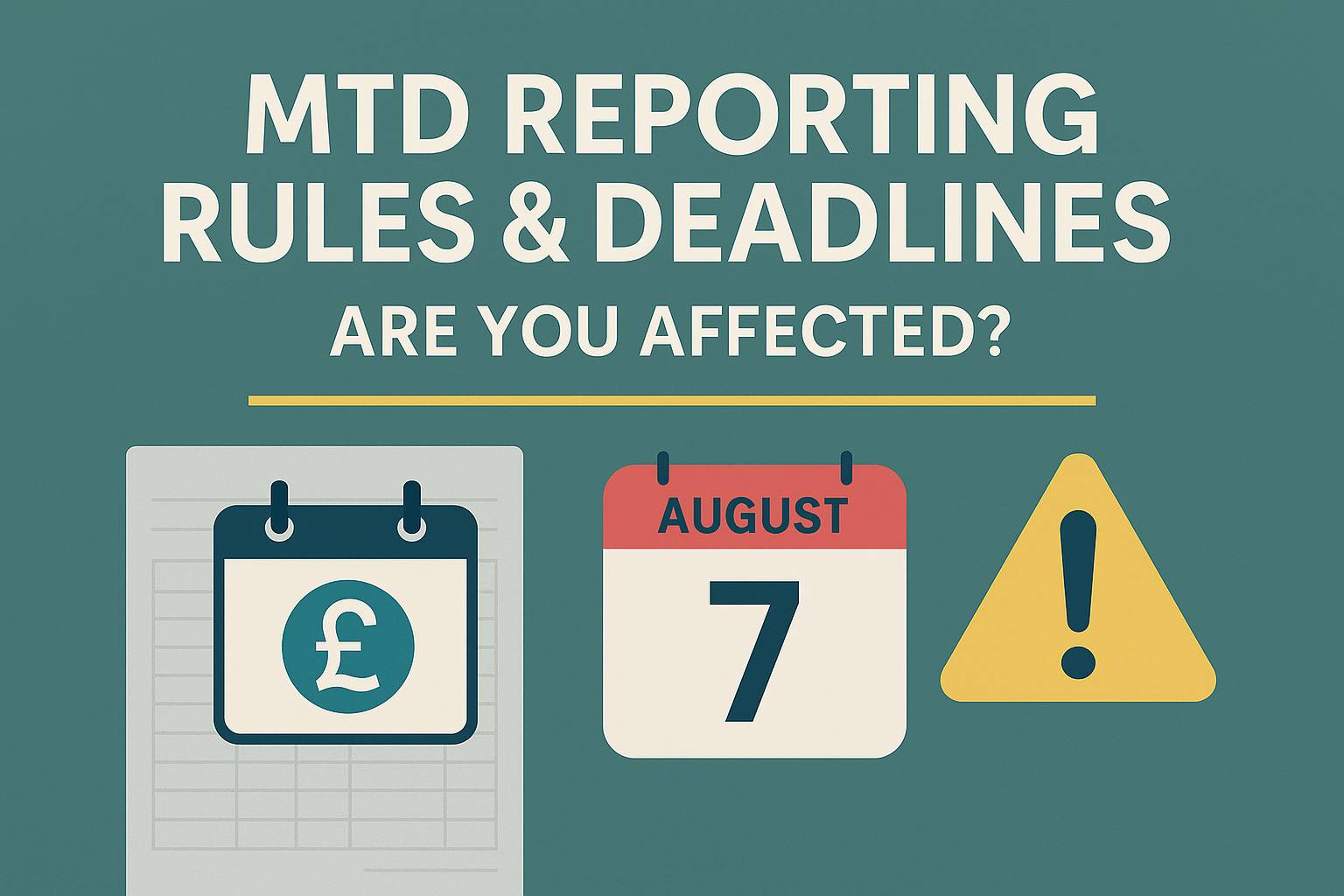

MTD Deadlines and Reporting Rules: What Self Employed and Landlords Must Know.

When will MTD apply to you? This guide covers all income thresholds, start dates, and quarterly submission deadlines for self-employed and landlords.