Tag: small business

-

HMRC’s 2025 Crackdown – What Small Businesses & Landlords Must Know

HMRC’s latest report shows a tougher stance in 2025: more compliance staff, AI tools, and faster debt collection. Small businesses and landlords are firmly in the spotlight. Find out what this crackdown means for you and the steps you can take to protect yourself.

-

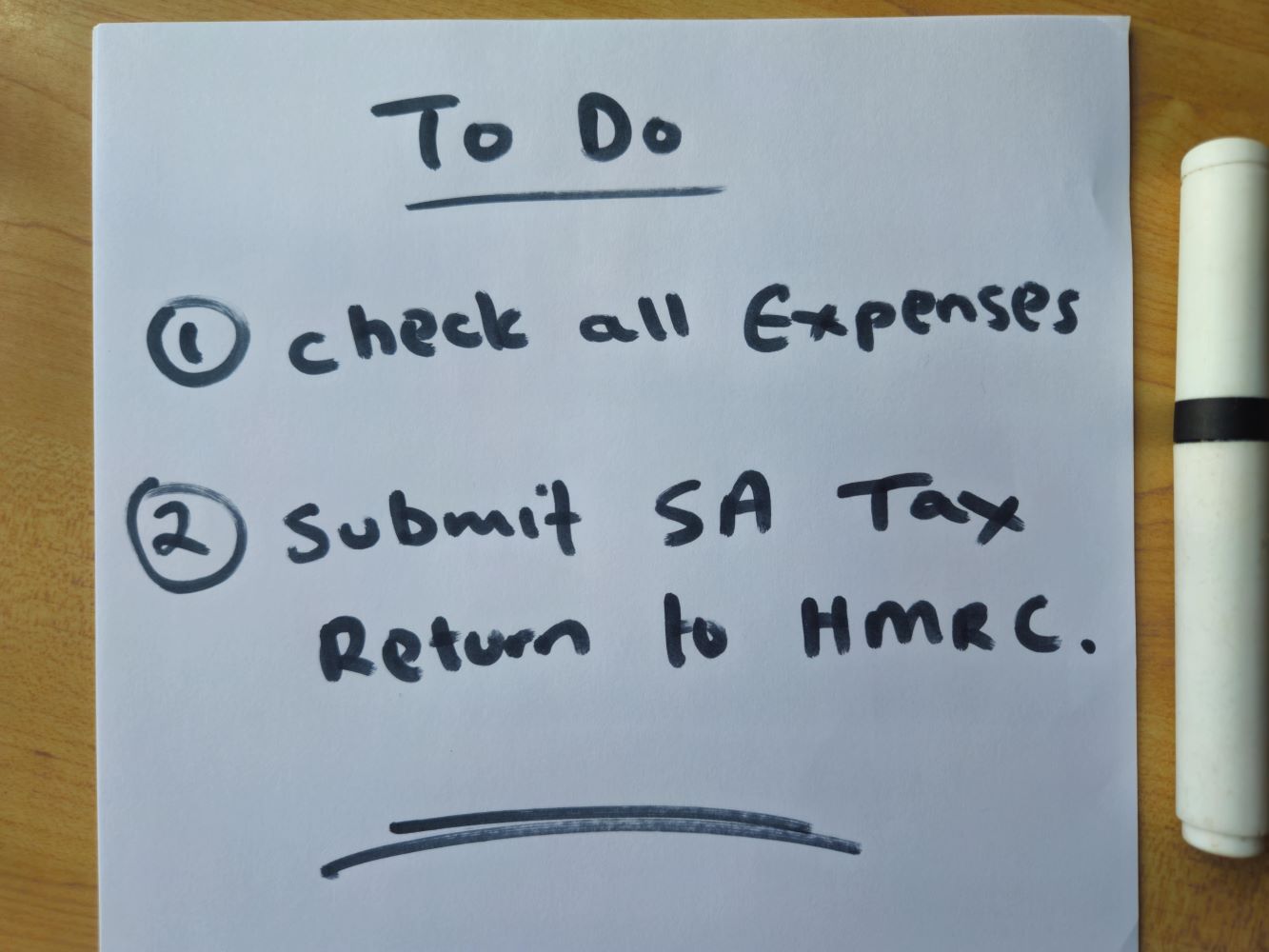

Top 5 Tax Mistakes UK Business Owners Make (and How to Avoid Them)

Avoid these 5 common tax mistakes UK business owners make. Learn how to stay compliant, save money, and avoid HMRC penalties in this quick guide.

-

Business Expenses – What You Can and Can’t Claim (UK 2025)

Confused about what business expenses you can claim in 2025? This guide breaks down HMRC rules for UK sole traders and limited companies, with tips to avoid common mistakes.

-

About Me

From a childhood bakery in Zambia to founding a modern UK accountancy firm, Dora Ngoma shares the story behind Grace Certified Accountants — and why people come first.

-

Navigating the Property Market — Your Guide to Buying, Selling and Investing

Welcome to the world of Rental Property. If you’re considering diving into the rental market, you won’t just become a landlord; — you’ll be stepping into the exciting realm of small business ownership. Owning rental property can be a lucrative venture, but it also comes with its own set of challenges and responsibilities. So how…

-

The Benefits of Proactive Tax Planning

Proactive tax planning helps you stay ahead of HMRC deadlines, reduce your liabilities, and avoid costly surprises. Here’s why every small business should start early.

-

VAT Made Easy — Your Fun Guide to Value Added Tax

New to VAT? This beginner’s guide explains when you need to register, what counts as taxable, and how to stay compliant — with real-life examples.

-

How to Prepare for the End of the Tax Year (Without the Panic)

The end of the tax year doesn’t have to be stressful. This guide shows you how to prepare with less panic and more confidence—so you can get your records in order and avoid last-minute surprises.

-

Don’t Be Late Filing Your Self-Assessment

Late with your Self-Assessment Tax Return? This guide explains what happens, how to reduce the penalties, and how to get back on track fast.