Tag: Self Employed

-

Making Tax Digital for the Self-Employed: April 2026 Changes That You Need to Know

Making Tax Digital (MTD) is evolving again. From April 2026, even more Self-employed people and Landlords will be required to keep digital records and submit quarterly updates. Here’s what you need to know to stay compliant.

-

The Benefits of Proactive Tax Planning

Proactive tax planning helps you stay ahead of HMRC deadlines, reduce your liabilities, and avoid costly surprises. Here’s why every small business should start early.

-

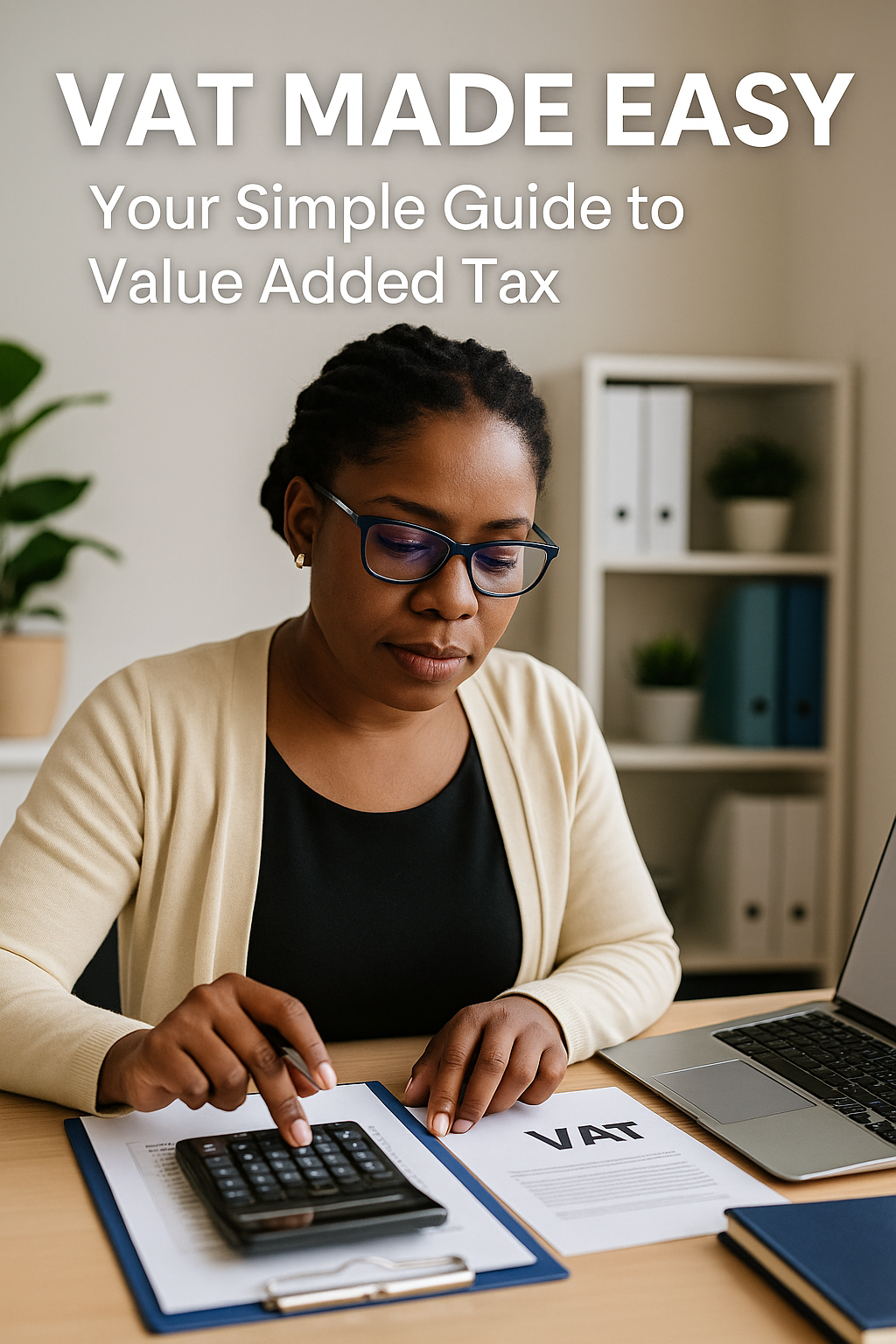

VAT Made Easy — Your Fun Guide to Value Added Tax

New to VAT? This beginner’s guide explains when you need to register, what counts as taxable, and how to stay compliant — with real-life examples.

-

Claiming Expenses When You’re Self-Employed — Your Fun Guide to Keeping More Cash

If you’re self-employed, claiming allowable expenses is essential for reducing your tax bill. This simple guide explains what you can and can’t claim — in plain English.

-

Welcome to our New Website

Welcome to the new online home of Grace Certified Accountants. We’re here to make accounting simpler, clearer, and more personal for you and your business. Explore our resources and get in touch to see how we can help.

-

The Impact of Making Tax Digital (MTD) on Your Business

Making Tax Digital affects nearly every business in the UK. This guide explains what’s changing, when it applies, and what you need to do to prepare.