Tag: accounting tips

-

Business Expenses – What You Can and Can’t Claim (UK 2025)

Confused about what business expenses you can claim in 2025? This guide breaks down HMRC rules for UK sole traders and limited companies, with tips to avoid common mistakes.

-

Sole Trader vs Limited Company — Which is Better for Tax?

Choosing between a Sole Trader and a Limited Company affects your tax, liability, and business structure. This guide breaks down the pros and cons, tax rules, and how to decide what’s right for you.

-

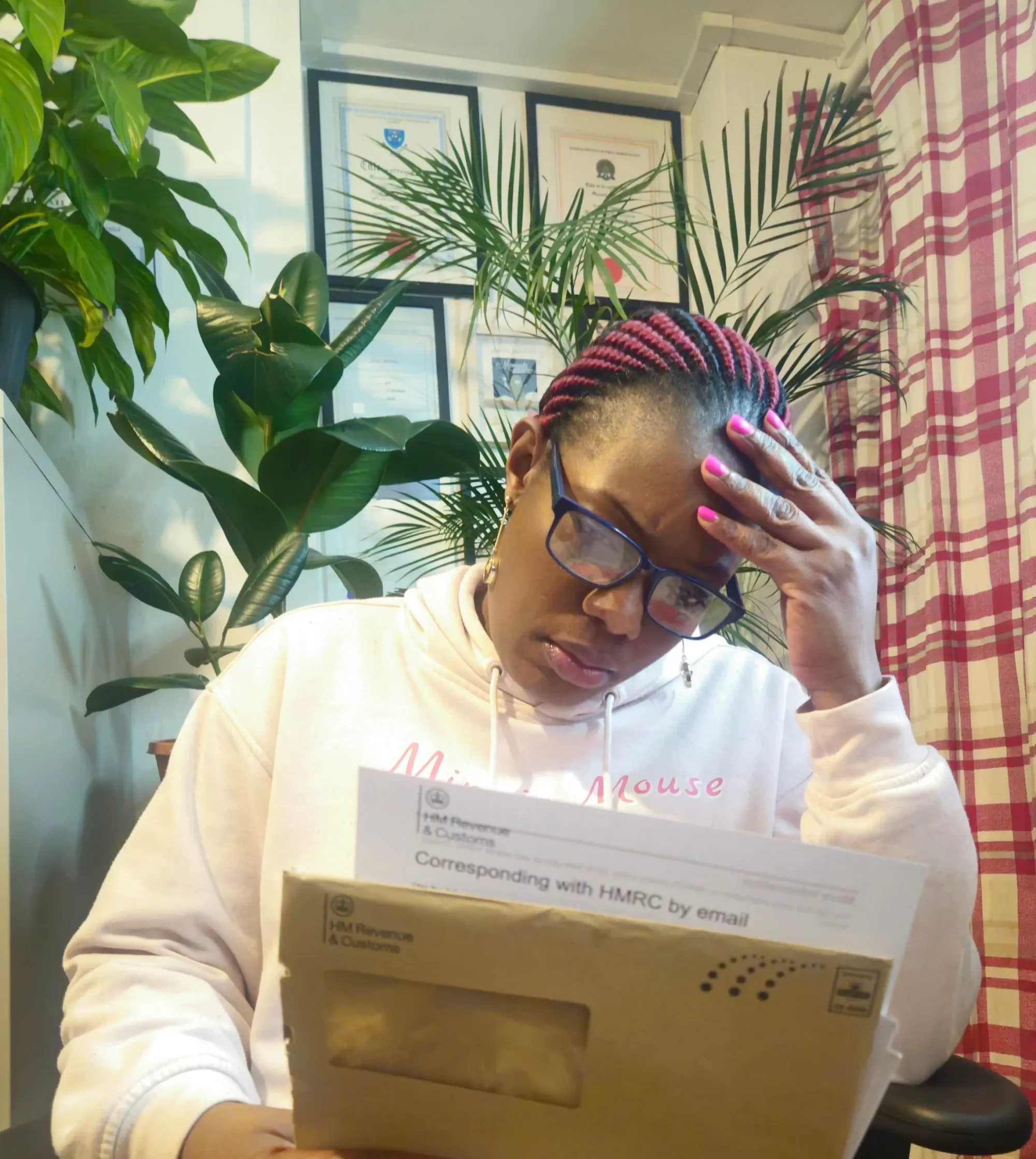

Surviving an HMRC Audit: What Triggers Investigations and How to Prepare

Worried about a potential HMRC audit? Learn what triggers an investigation, how to stay off HMRC’s radar, and what to do if you get that dreaded letter.