Category: Wealth Management

-

What Happens If You Die Owning a Rental Property?

What happens to your rental property when you die? This guide explains how Inheritance Tax and Capital Gains Tax work on death, what your heirs inherit, and the planning options to protect your family from unnecessary tax.

-

The Difference Between Capital and Revenue Expenses on Your Rental Property.

Not all property expenses are treated the same for tax. Learn the key differences between capital and revenue expenses, what you can claim, and when to report them — so you don’t fall foul of HMRC rules.

-

Top Ways to Legally Pay Less on Your Self-Assessment Tax Bill

No one wants to pay more tax than they have to. These 8 tips will help you reduce your Self-Assessment tax bill legally — and keep more of your hard-earned cash.

-

Understanding Trusts — What They Are and Why They Matter

Confused about Trusts? This simple guide explains what they are, how they’re used in property and estate planning, and when to consider one.

-

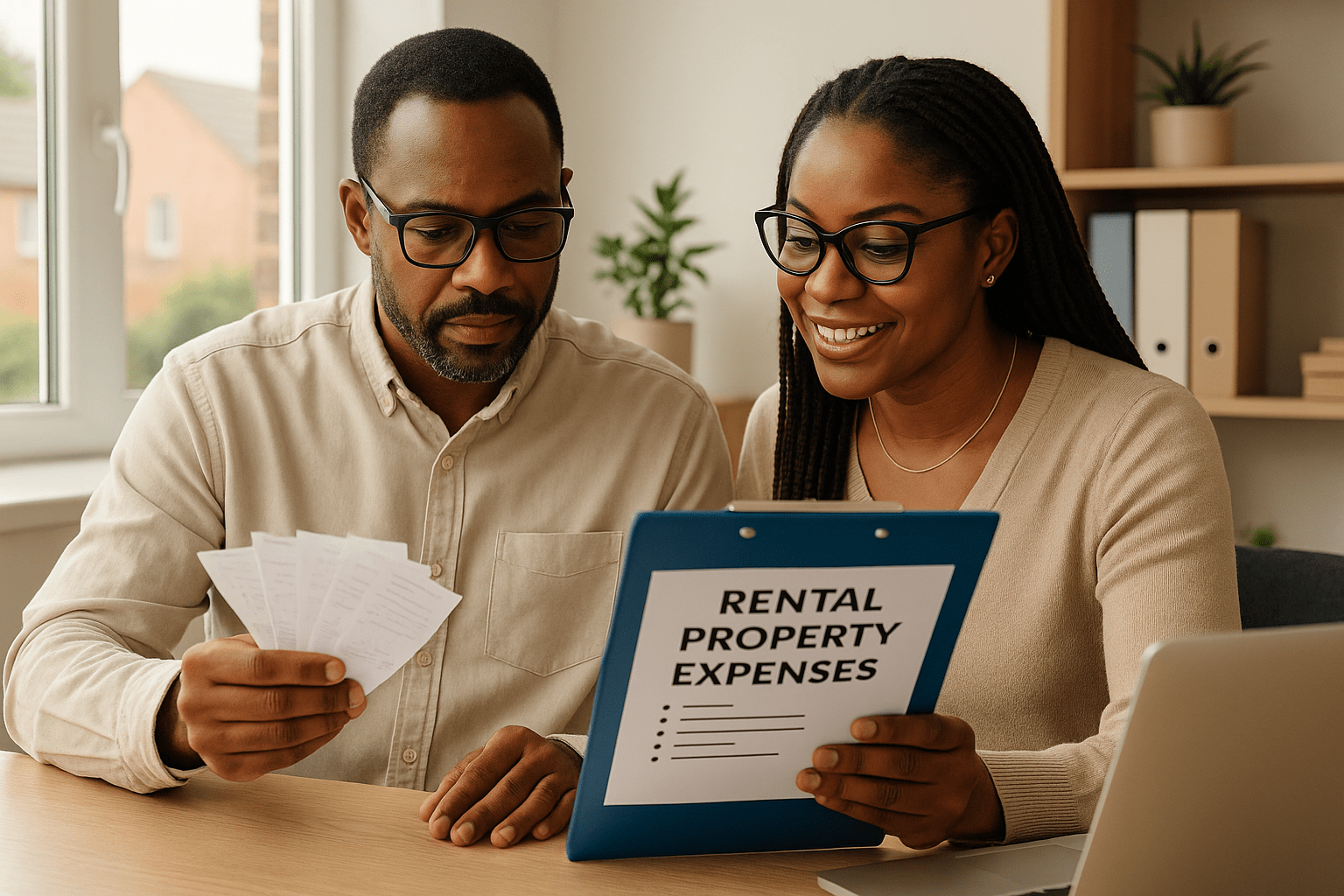

Understanding Rental Property Expenses — What You Can Claim

If you rent out property, understanding what you can and can’t claim as expenses is essential. This guide breaks down allowable costs—from maintenance to letting fees—in plain English.

-

Help from an Accountant — Why It’s One of the Best Decisions You’ll Ever Make

Struggling with taxes or unsure if you’re doing things right? A good accountant doesn’t just file your returns — they save you money, reduce stress and help your business grow. Here’s why working with one could be the smartest move you make.