Category: Small Business Growth

-

Navigating the Property Market — Your Guide to Buying, Selling and Investing

Welcome to the world of Rental Property. If you’re considering diving into the rental market, you won’t just become a landlord; — you’ll be stepping into the exciting realm of small business ownership. Owning rental property can be a lucrative venture, but it also comes with its own set of challenges and responsibilities. So how…

-

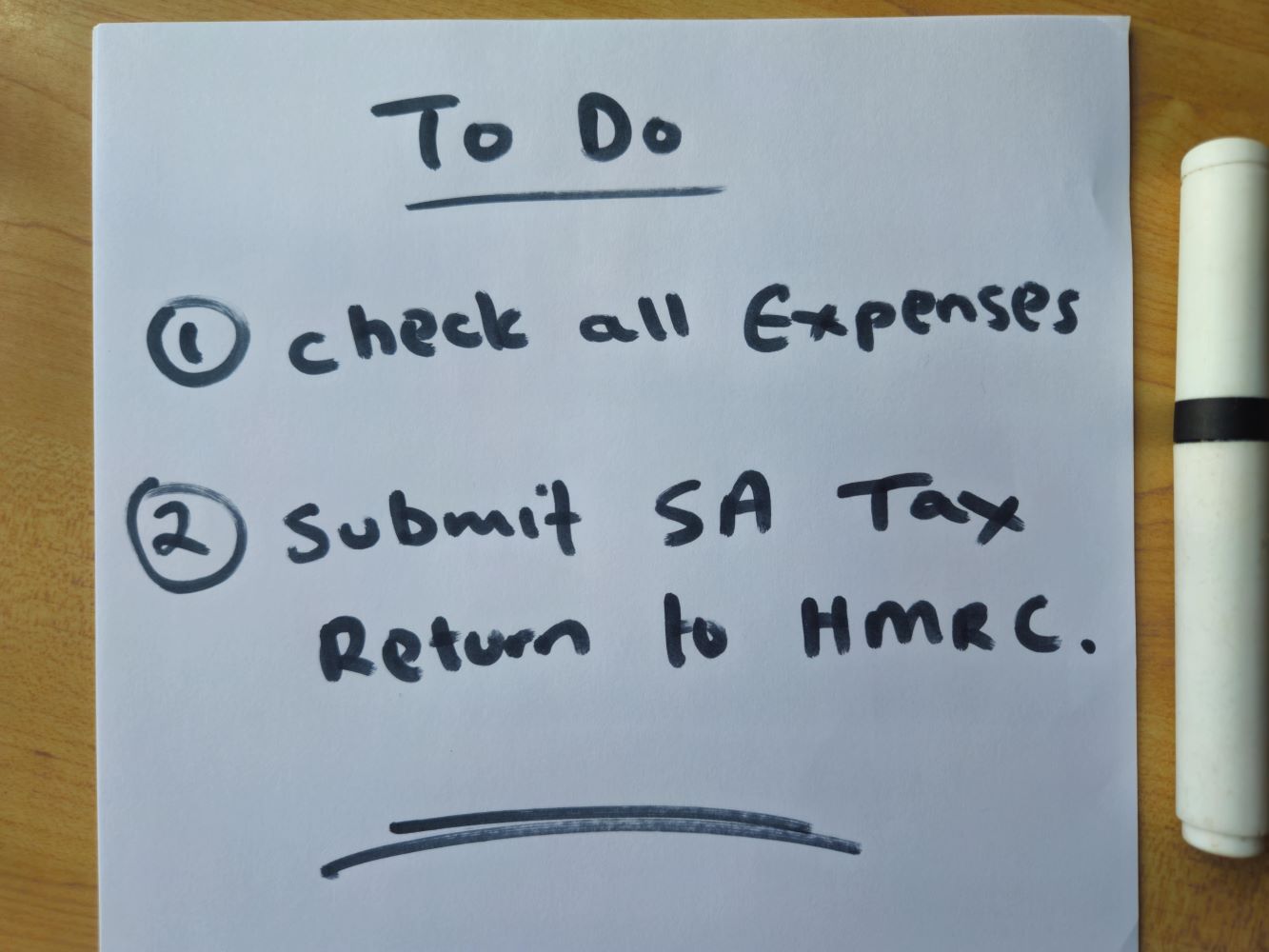

The Benefits of Proactive Tax Planning

Proactive tax planning helps you stay ahead of HMRC deadlines, reduce your liabilities, and avoid costly surprises. Here’s why every small business should start early.

-

VAT Made Easy — Your Fun Guide to Value Added Tax

New to VAT? This beginner’s guide explains when you need to register, what counts as taxable, and how to stay compliant — with real-life examples.

-

Understanding Rental Property Expenses — What You Can Claim

If you rent out property, understanding what you can and can’t claim as expenses is essential. This guide breaks down allowable costs—from maintenance to letting fees—in plain English.

-

How to Prepare for the End of the Tax Year (Without the Panic)

The end of the tax year doesn’t have to be stressful. This guide shows you how to prepare with less panic and more confidence—so you can get your records in order and avoid last-minute surprises.

-

Help from an Accountant — Why It’s One of the Best Decisions You’ll Ever Make

Struggling with taxes or unsure if you’re doing things right? A good accountant doesn’t just file your returns — they save you money, reduce stress and help your business grow. Here’s why working with one could be the smartest move you make.

-

It Takes a Village to Raise a Child — But What About a Business?

Running a business can feel lonely — but it shouldn’t be. Just like raising a child takes a village, building a successful business takes a strong support network. Here’s why you need one, and who should be in yours

-

Don’t Be Late Filing Your Self-Assessment

Late with your Self-Assessment Tax Return? This guide explains what happens, how to reduce the penalties, and how to get back on track fast.

-

Welcome to our New Website

Welcome to the new online home of Grace Certified Accountants. We’re here to make accounting simpler, clearer, and more personal for you and your business. Explore our resources and get in touch to see how we can help.