Category: Self Employment, Business Expenses, Tax Planning

-

Financial Habits That Hold Back Small Business Owners – And How to Fix Them

Are bad money habits holding back your business? From mixing finances to poor record-keeping, discover the most common financial mistakes small business owners make — and the practical steps you can take to fix them.

-

How Do You Pay Yourself When Your Business Is a Limited Company?

Running a UK limited company? Discover how to pay yourself legally and tax-efficiently in 2025 — from salaries and dividends to director’s loans and expenses.

-

Top 5 Tax Mistakes UK Business Owners Make (and How to Avoid Them)

Avoid these 5 common tax mistakes UK business owners make. Learn how to stay compliant, save money, and avoid HMRC penalties in this quick guide.

-

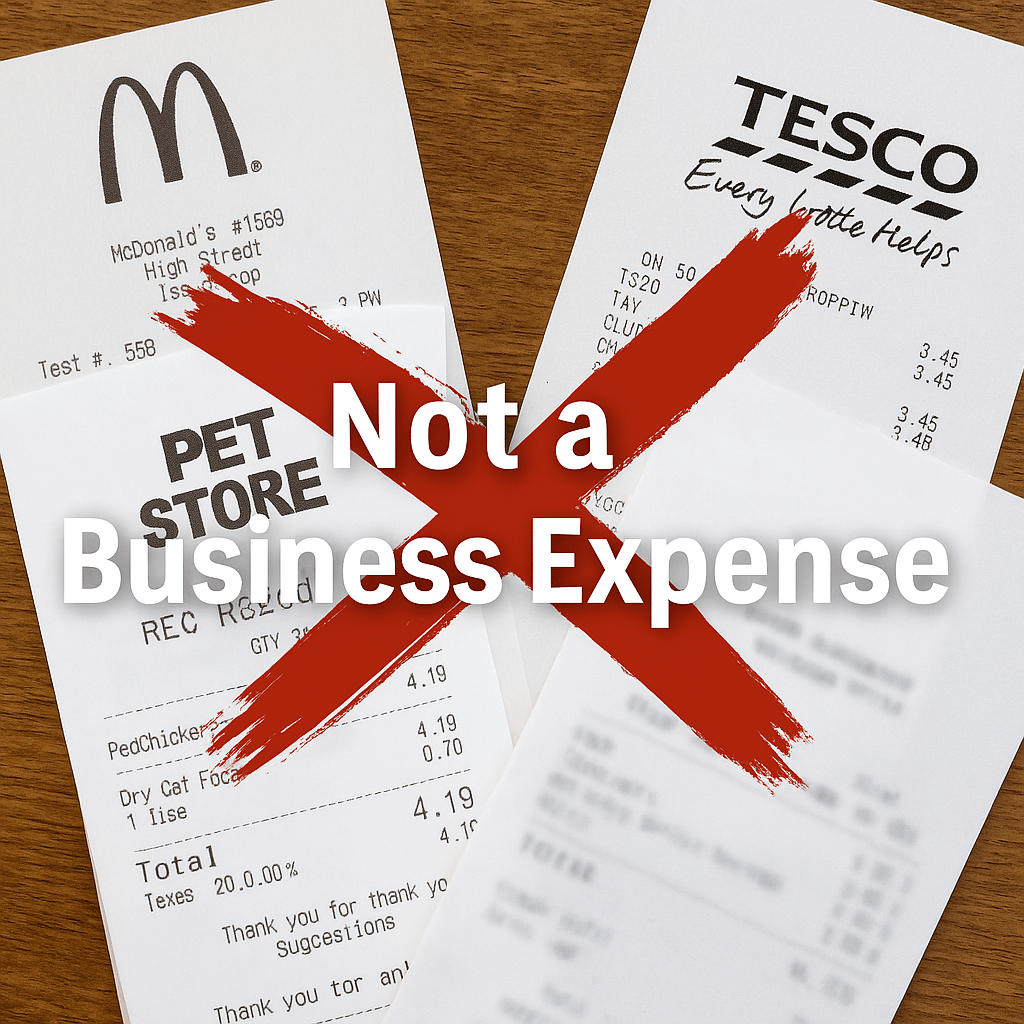

Not an Expense: Common Things Self-Employed People Try to Claim (That HMRC Will Reject)

Think you can claim McDonald’s, pet food, or your weekly shop as a business expense? HMRC says otherwise. Here’s what self-employed people get wrong — and what you really can’t claim.

-

Can Landlords Still Claim Mortgage Interest? Section 24 Explained (2025 Guide)

Section 24 has changed how landlords claim mortgage interest. Learn how the 20% tax credit works, why your taxable profits look higher and what you can still claim in 2025.

-

Claiming Expenses When You’re Self-Employed — Your Fun Guide to Keeping More Cash

If you’re self-employed, claiming allowable expenses is essential for reducing your tax bill. This simple guide explains what you can and can’t claim — in plain English.