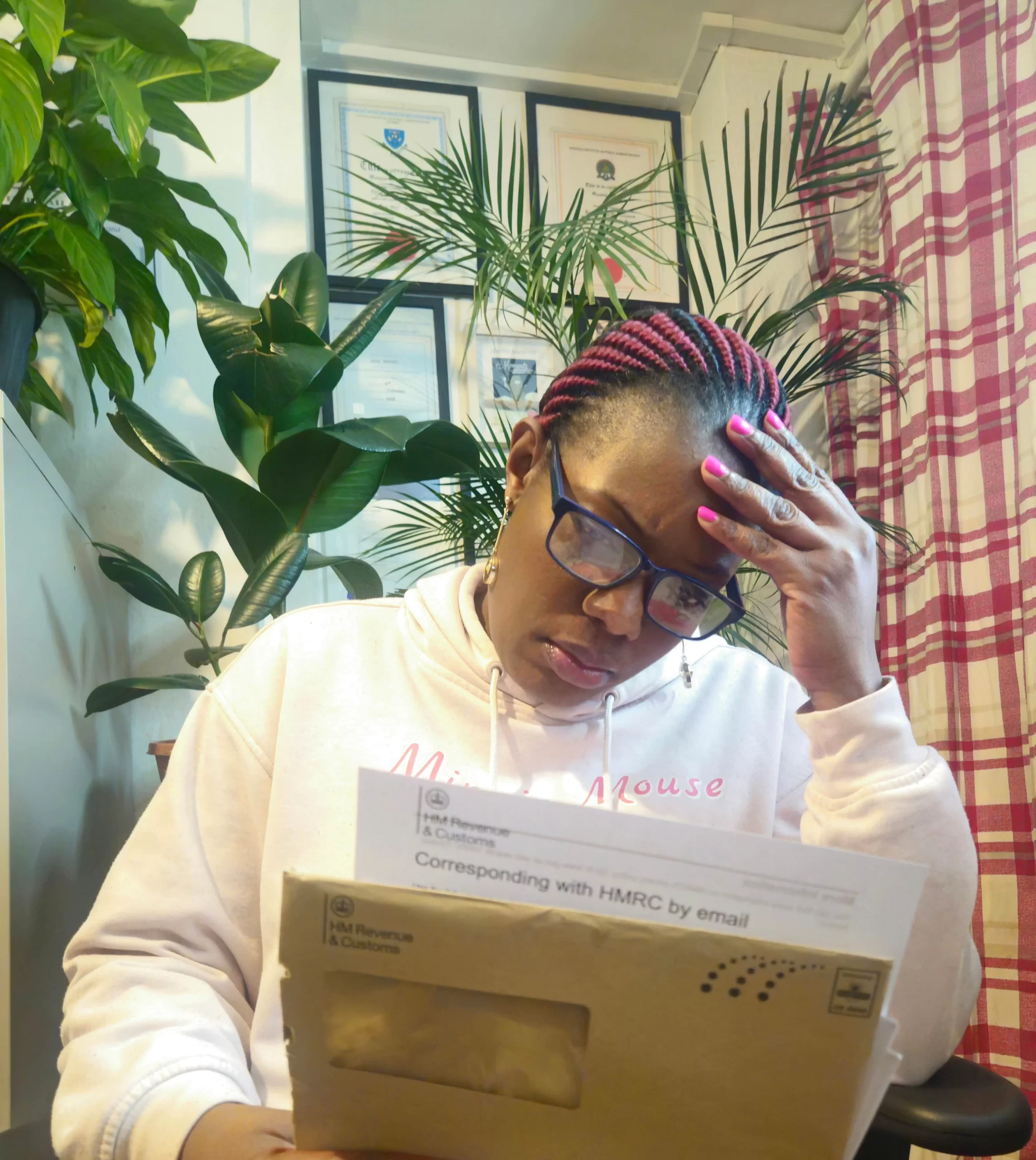

As the end of the tax year approaches, are you starting to experience a familiar sense of dread? You’re not alone. A great many small business owners and Self-Employed people feel just the same. The thought of gathering paperwork, crunching numbers and filing taxes can be overwhelming.

It’s not as bad as it seems, though. With a little preparation and organisation, you can tackle the end of the tax year without the panic. Here are some effective ways to get ready for the tax season like a pro.

Want to reduce your tax bill before 5 April? In this video, I share practical, legal ways to make the most of your allowances and pay less tax.

1. Get Organised: Your Tax Year Survival Kit

The first step to a stress-free tax season is getting organised. You need to create a “Tax Year Survival Kit” that includes everything you need to prepare for filing. This should include:

- Folders for Documents — Create separate folders for Income, Expenses, Receipts and any other relevant documents. This will make it easy to find what you need when it’s time to file.

- Digital Tools — Consider using accounting software, like QuickBooks or FreeAgent, to keep track of your finances throughout the year. These tools can simplify record-keeping and make tax time a piece of cake.

- Checklists — Create a checklist of everything you’ll need to gather for your Tax Return. This will help you stay on track and ensure you don’t miss anything important.

2. Have Fun Reviewing Your Financial Records

No, you didn’t read that wrong!! Now that you’re organised, it’s time to review your financial records, but it doesn’t have to be a grim slog. Think of it instead as an audit party. Here’s how to make it enjoyable:

- Set the Mood — Put on your favourite playlist, grab a snack and make it a fun activity, rather than a chore.

- Check Your Income — Review all your sources of income, including Sales, freelance work and any other revenue streams. Make sure everything’s accounted for.

- Track Your Expenses — Go through your expenses and categorise them. This is a great opportunity to identify any deductions you may have missed throughout the year.

3. Maximise Your Deductions — Also Known as a Treasure Hunt

Instead of a task to be got through, you could think of reviewing your expenses as a treasure hunt for deductions. Here are some common deductions you might be able to claim:

Need help spotting deductions? Watch the video above where I share key areas that could help you save.

- Home Office Expenses — If you work from home, you can claim a portion of your household bills, such as electricity and internet.

- Travel Costs — Keep track of any business-related travel expenses you may have racked up, including mileage, public transport and accommodation.

- Office Supplies and Equipment — Don’t forget to include the costs of stationery, computers and other office essentials.

- Professional Fees — If you’ve hired an Accountant or Consultant, their fees are deductible, too.

4. Avoid Surprises When Planning for Payments

One of the biggest sources of panic during tax season is the fear of unexpected tax bills. To avoid surprises, plan ahead:

- Estimate Your Tax Liability — Use your financial records to estimate how much tax you’ll owe. This will help you budget accordingly and avoid any last-minute scrambles.

- Set Aside Funds — If you anticipate owing taxes, set aside a set amount of your income throughout the year to cover your tax bill. This means you won’t be caught off guard when it’s time to pay.

5. Get a Tax-Season Sidekick Through Professional Help

If the thought of preparing your taxes still feels overwhelming, don’t hesitate to get professional help. An Accountant can be your tax-season sidekick, guiding you through the process and finding all the deductions you might have missed. Here’s how to find the right one:

- Ask for Recommendations — Reach out to fellow business owners for recommendations on reliable Accountants.

- Check Qualifications — Ensure your Accountant is qualified and has experience working with small businesses or Self-Employed individuals.

- Discuss Fees Upfront — Be clear about both the fees and the services they provide, to avoid any surprises later on.

Happy Tax Season

Preparing for the end of the tax year doesn’t have to be a panic-inducing experience. By getting organised, reviewing your financial records, maximising your deductions, planning for payments and seeking professional help if needed, you can tackle tax season with confidence.

So take a deep breath, put on your favourite tunes and get ready to conquer the end of the tax year like a pro. If you have any questions or need further assistance, feel free to get in touch with me here at Grace Certified Accountants. Happy tax season!

💡 Related Reading: If tax returns give you anxiety, our guide to making your return easier is a great next step. Claiming Expenses When You’re Self – Employed – Your Fun Guide to Keeping More Cash