Tag: tax planning

-

Selling a Property You Own With Your Ex – What You Need to Know About Tax and Legal Costs

Selling or buying out a property after divorce? Learn how court orders, CGT, SDLT, and hidden costs can change what you owe — and when the “no gain/no loss” rule applies.

-

Sole Trader vs Limited Company — Which is Better for Tax?

Choosing between a Sole Trader and a Limited Company affects your tax, liability, and business structure. This guide breaks down the pros and cons, tax rules, and how to decide what’s right for you.

-

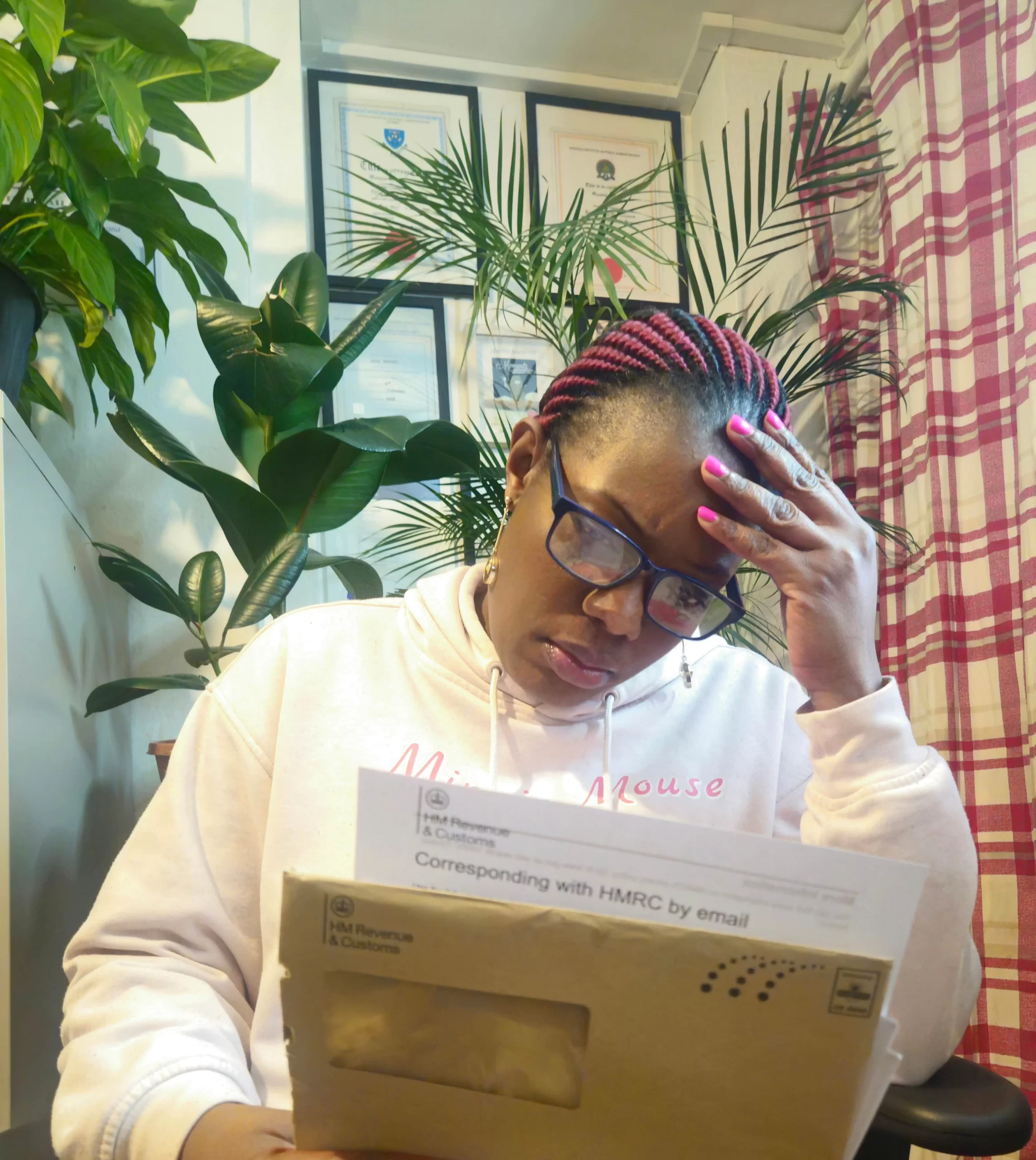

Why Do People Leave Their Tax Returns Late?

Many business owners delay their tax returns until it’s almost too late. Here’s why — and how filing early can save you time, stress, and money.

-

Understanding Trusts — What They Are and Why They Matter

Confused about Trusts? This simple guide explains what they are, how they’re used in property and estate planning, and when to consider one.

-

The Benefits of Proactive Tax Planning

Proactive tax planning helps you stay ahead of HMRC deadlines, reduce your liabilities, and avoid costly surprises. Here’s why every small business should start early.

-

How to Prepare for the End of the Tax Year (Without the Panic)

The end of the tax year doesn’t have to be stressful. This guide shows you how to prepare with less panic and more confidence—so you can get your records in order and avoid last-minute surprises.