Category: Tax Planning

-

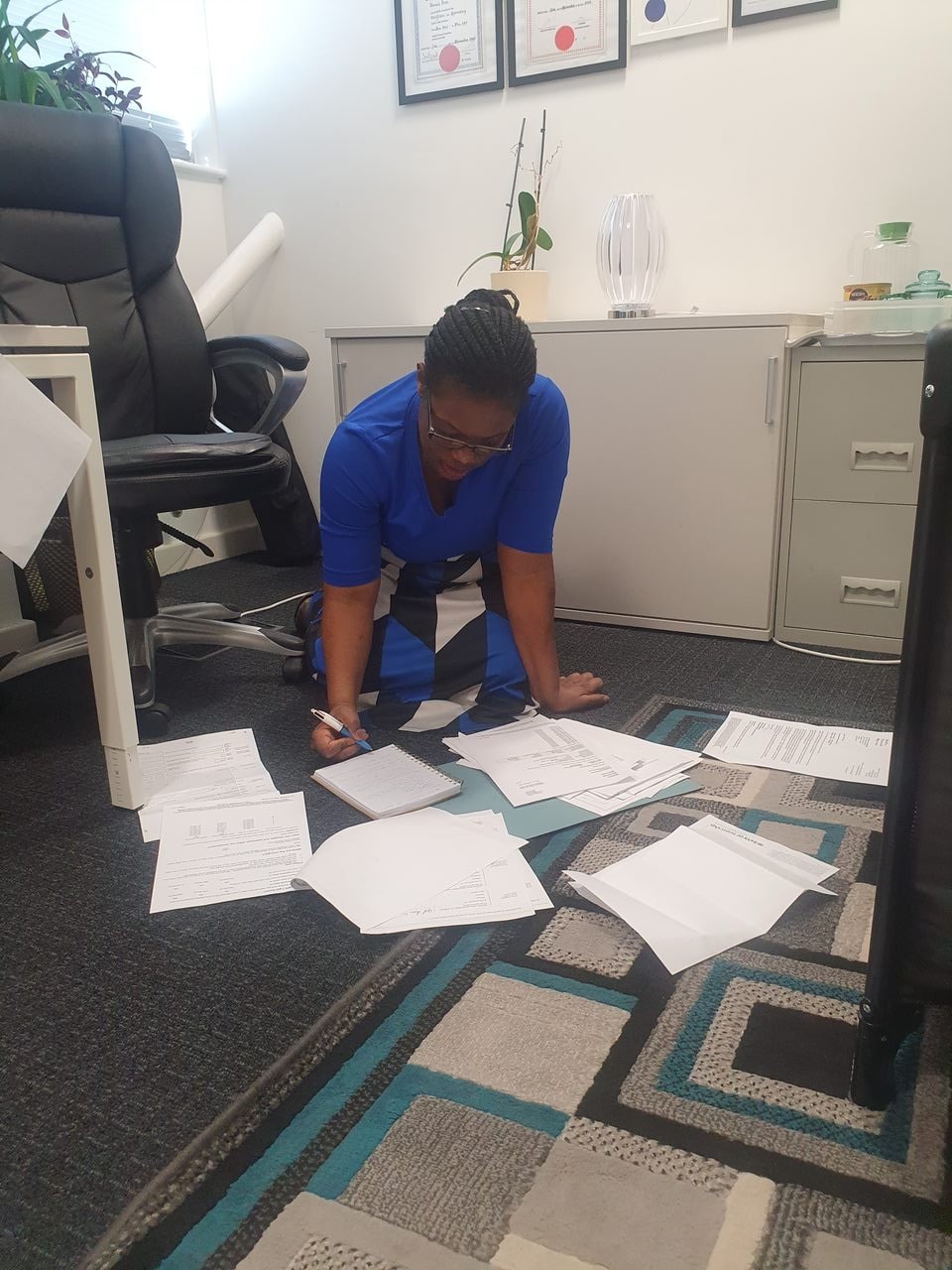

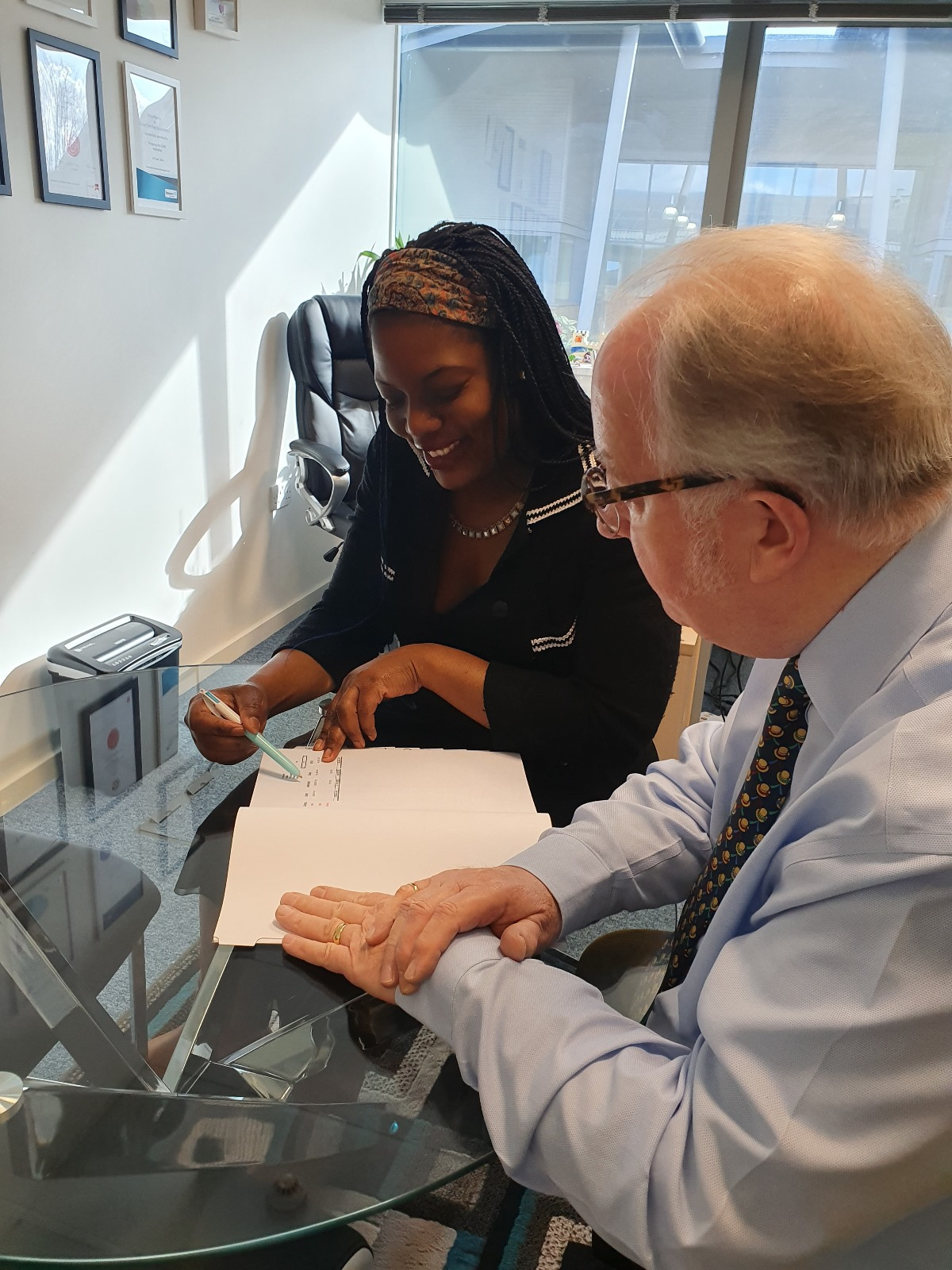

Help from an Accountant — Why It’s One of the Best Decisions You’ll Ever Make

Struggling with taxes or unsure if you’re doing things right? A good accountant doesn’t just file your returns — they save you money, reduce stress and help your business grow. Here’s why working with one could be the smartest move you make.

-

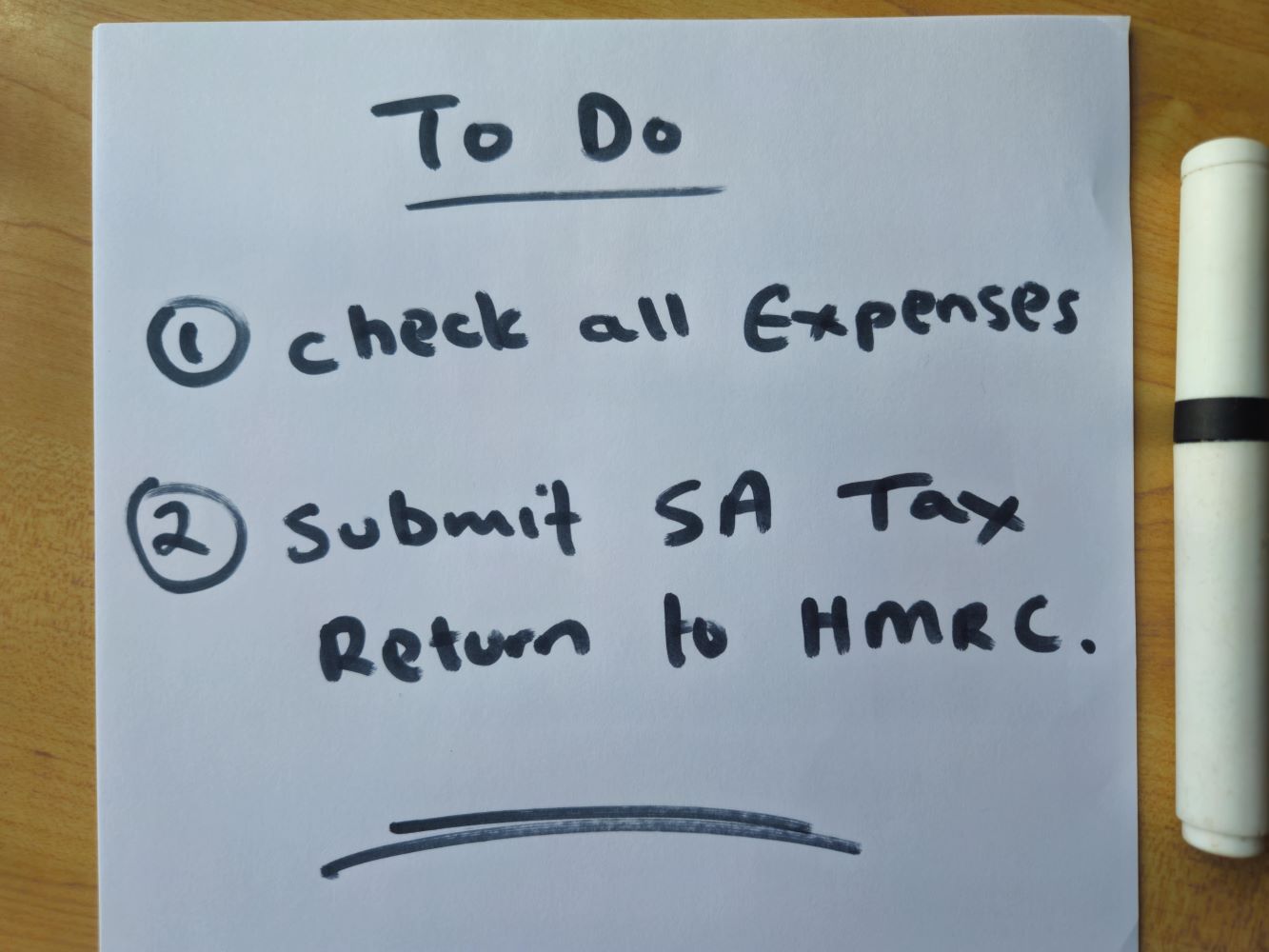

Making Your Tax Return Easier — Four Tips That Will Help You

Tax return time doesn’t have to be stressful. These four practical tips will help you file with confidence, stay compliant, and get it done with less hassle.

-

Don’t Be Late Filing Your Self-Assessment

Late with your Self-Assessment Tax Return? This guide explains what happens, how to reduce the penalties, and how to get back on track fast.

-

The Impact of Making Tax Digital (MTD) on Your Business

Making Tax Digital affects nearly every business in the UK. This guide explains what’s changing, when it applies, and what you need to do to prepare.

-

Navigating the Complex World of Tax Compliance for Small Businesses

Tax compliance doesn’t have to be complicated. This guide explains key responsibilities, deadlines, and tips for keeping your small business on the right side of HMRC.