Category: Tax Planning

-

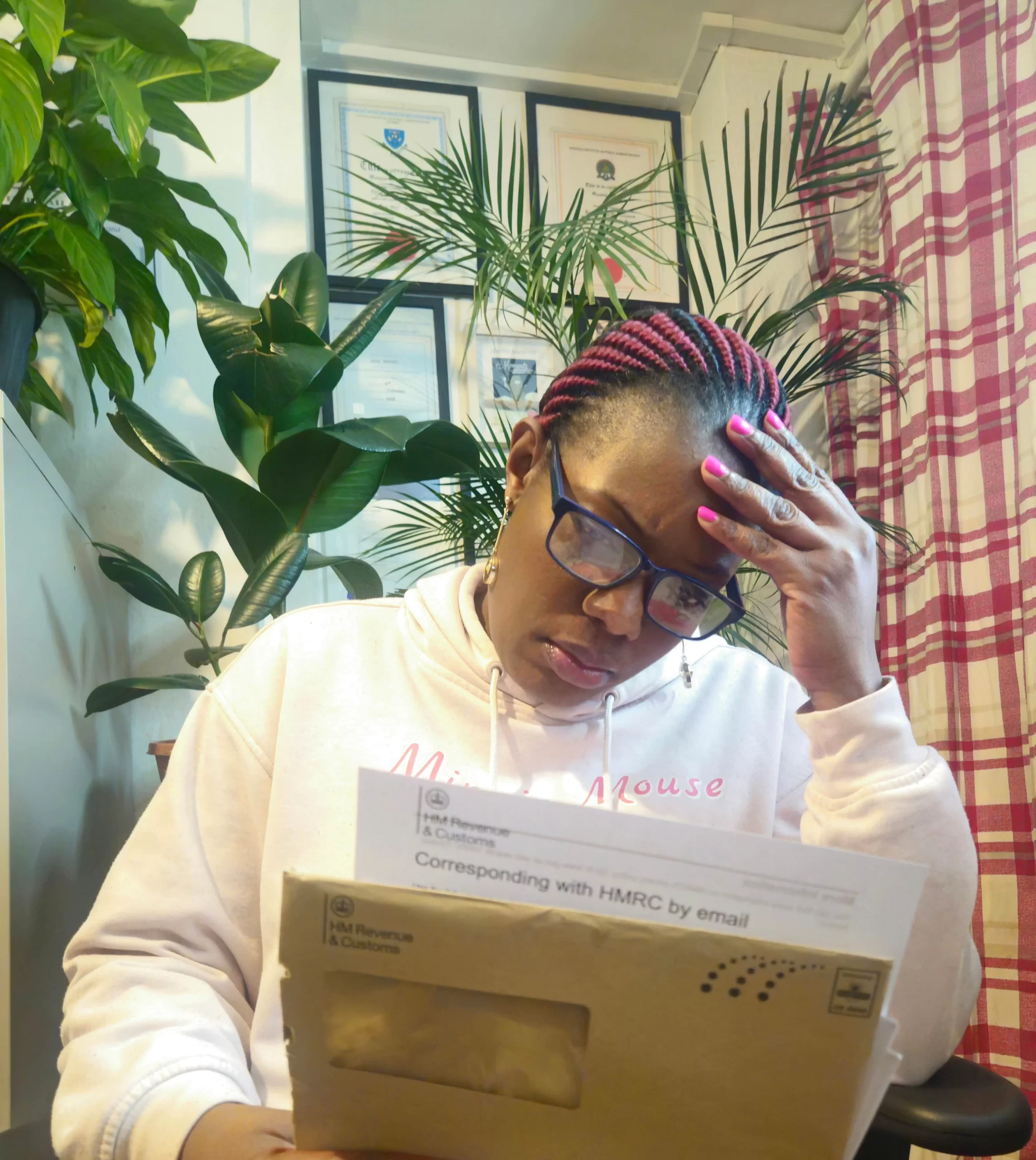

Top Ways to Legally Pay Less on Your Self-Assessment Tax Bill

No one wants to pay more tax than they have to. These 8 tips will help you reduce your Self-Assessment tax bill legally — and keep more of your hard-earned cash.

-

Why Do People Leave Their Tax Returns Late?

Many business owners delay their tax returns until it’s almost too late. Here’s why — and how filing early can save you time, stress, and money.

-

Self-Employed Pensions: How To Take Care of Future You

Being your own boss means taking charge of your retirement too. This blog shows how to build your pension, make use of tax relief, and look after future you.

-

Capital Gains Tax on Property — What You Need to Know

If you’re thinking about selling a property, understanding Capital Gains Tax is essential. This guide explains when you’ll pay it, how it’s calculated, and what reliefs you might be entitled to.

-

Understanding Trusts — What They Are and Why They Matter

Confused about Trusts? This simple guide explains what they are, how they’re used in property and estate planning, and when to consider one.

-

VAT Made Easy — Your Fun Guide to Value Added Tax

New to VAT? This beginner’s guide explains when you need to register, what counts as taxable, and how to stay compliant — with real-life examples.

-

Understanding Rental Property Expenses — What You Can Claim

If you rent out property, understanding what you can and can’t claim as expenses is essential. This guide breaks down allowable costs—from maintenance to letting fees—in plain English.

-

Claiming Expenses When You’re Self-Employed — Your Fun Guide to Keeping More Cash

If you’re self-employed, claiming allowable expenses is essential for reducing your tax bill. This simple guide explains what you can and can’t claim — in plain English.

-

How to Prepare for the End of the Tax Year (Without the Panic)

The end of the tax year doesn’t have to be stressful. This guide shows you how to prepare with less panic and more confidence—so you can get your records in order and avoid last-minute surprises.