Tag: capital gains tax

-

Receiving Inheritance from Abroad – What UK Residents Need to Know

A clear guide for UK residents who receive inheritance from abroad. Learn when UK tax applies, how domicile affects IHT, and what income or gains you may need to declare when inherited assets start generating money.

-

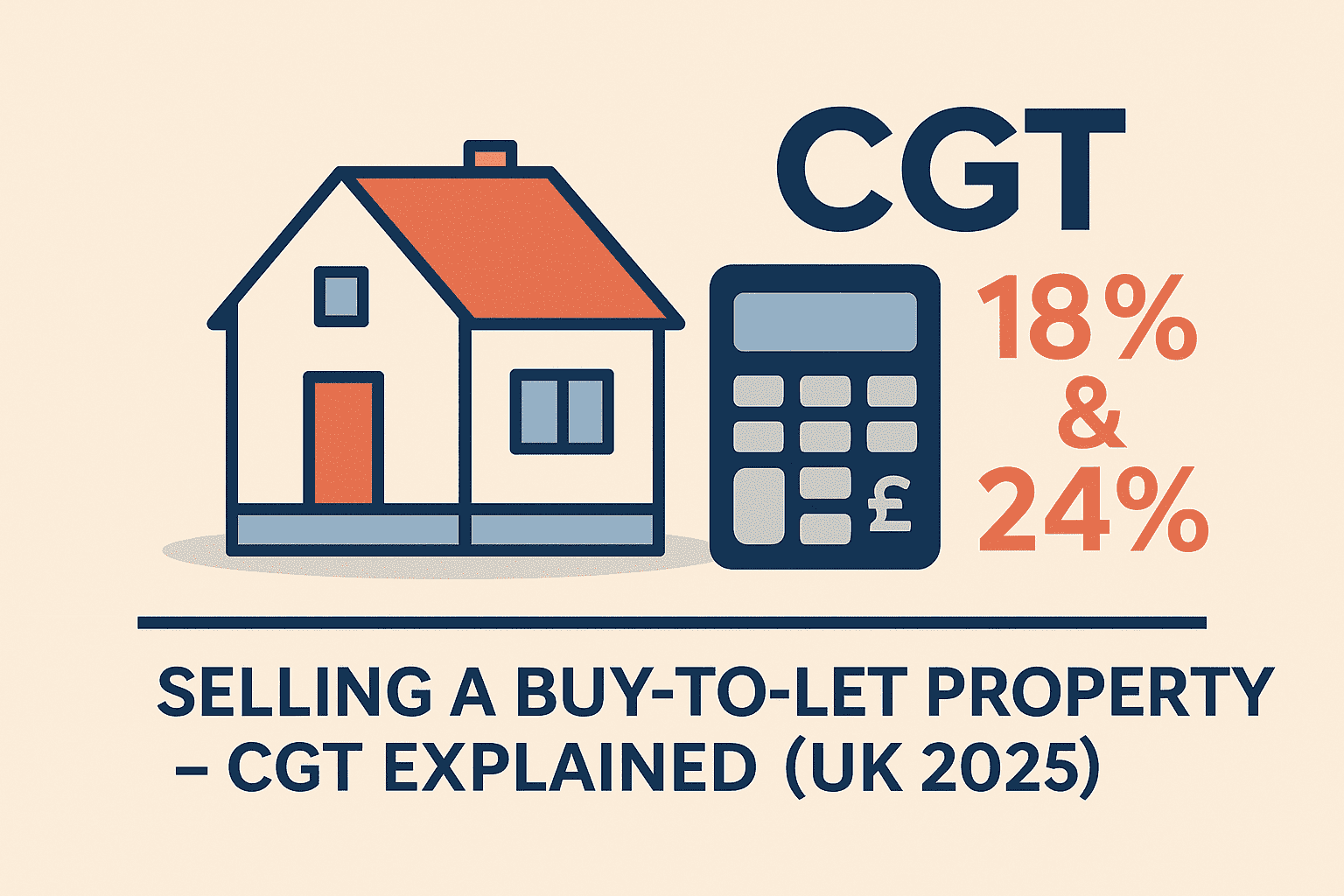

Selling a Buy-to-Let Property – CGT Explained (UK 2025)

Selling a rental property can trigger Capital Gains Tax. This guide shows exactly how to calculate the gain, what costs you can deduct, and how to plan your sale to stay compliant.

-

Selling a Property You Own With Your Ex – What You Need to Know About Tax and Legal Costs

Selling or buying out a property after divorce? Learn how court orders, CGT, SDLT, and hidden costs can change what you owe — and when the “no gain/no loss” rule applies.

-

Gifting Property to Your Children (UK 2025/26) – Full Guide

This complete five-part guide explains everything you need to know about gifting property to your children in the UK — from Capital Gains Tax and Inheritance Tax to the 7-year rule, Gift With Reservation, and trust-based planning options.

-

Capital Gains Tax on Gifting Property Explained (2025/26)

Gifting property isn’t always tax-free. HMRC treats it as a sale at market value, meaning you could owe Capital Gains Tax even when you give it away. Learn how CGT works, what reliefs apply, and how to plan ahead.

-

What Counts as a Gift in the Eyes of HMRC?

Many parents want to share property with children during their lifetime to avoid disputes later. But HMRC has strict rules on what counts as a gift. Learn how Capital Gains Tax, Inheritance Tax and the settlements rule apply, and avoid costly mistakes when gifting or transferring property.

-

Do You Pay Capital Gains Tax on Inherited Property? (UK Guide)

Inheriting property doesn’t trigger Capital Gains Tax — but selling it might. Here’s how CGT works after inheritance and what to watch out for.

-

Can You Sell a Property to Your Child Below Market Value? (UK Tax Rules)

Selling a property to your child at a discount might seem generous — but for HMRC, it’s a part-sale, part-gift. Here’s how it affects your tax bill.

-

Can I Gift My Property to a Partner, Niece or Nephew Without Paying Tax?

You can gift property to anyone — but it’s rarely tax-free. We explain the CGT and IHT rules for gifting to a partner, niece, or nephew.