How to Reduce my Tax Bill? 5 Common Tax Deductions that Small Business Owners Often Overlook They say that only two things are certain in life: death and taxes. Paying tax is inevitable but there are things you can do to reduce the percentage of your income that the taxman takes. As a small business owner, the likelihood is that you’re probably paying too much tax, which is why we’ve put together a list of the most overlooked deductions to help you reduce your bill. Of course, in order to claim the following tax deductions, you need to be...

Read More

Archives for Blog

How an Accountant Can Help Maintain Your Business Credit Score? 5 Credit Score Tips for Growing your Business Credit Rating

How an Accountant Can Help Maintain Your Business Credit Score? 5 Credit Score Tips for Growing your Business Credit Rating Let start from the beginning… If you are Self Employed or run a Limited Company, and you are looking to improve your business credit score, you must be aware that, in addition to the day to day running activities of your business, there are other obligations that you will need to fulfil at the end of each year. As a Self Employed Individual, you will need to submit a Self Assessment Tax Return. It’s slightly different if you...

Read More

Cash Flow vs Profit: What’s the Difference and Which is More Important?

Cash Flow vs Profit: What’s the Difference and Which is More Important? It’s the age-old debate: cash flow or profit? Whilst the two are undoubtedly related, they are certainly not the same thing and business owners must often sacrifice one at the expense of the other. In the long term, a business needs both positive cash flow and profits to continue operation, but which one should entrepreneurs be prioritising? Some say that “cash is king” whilst others argue that “profit is everything,” but what is the truth? Let’s take a closer look and find out. What is...

Read More

How to Keep Track Of My Cash Flow? 5 Bookkeeping Habits to Ensure Your Business Won’t Run Out of Funds

How to Keep Track Of My Cash Flow? 5 Bookkeeping Habits to Ensure Your Business Won’t Run Out of Funds Bookkeeping is about more than just complying with government regulations when tax season rolls around. A solid bookkeeping system provides you with essential information that you can use to improve your business and ensure financial success. According to a news article and research by the ONS (Office for National Statistics), Almost half of UK businesses are within six months of running out of cash, despite the lifeline provided by the government during the COVID-19 pandemic. ...

Read More

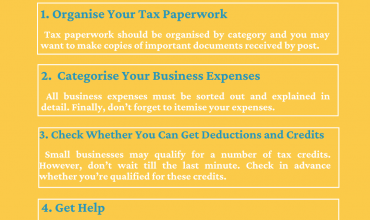

Are you Ready For Your Tax Return? Four Tax Preparation Tips to Follow

Are You Ready For Your Tax Return? Four Tax Preparation Tips to Follow If you want to avoid the stress of the tax period, follow these four simple steps to prepare your business in advance. Tax season is one of the most stressful periods of the year for a business owner. With proper planning, however, you can change that. It’s essential to start preparing for the filing of your business tax return in advance so you have time to gather all relevant records. Take a look at the following tax preparation tips that can make the...

Read More

Do I Need an Accountant To Do My Tax Return? 5 Reasons Not to DIY Your Tax Return For Your Small Business

Do I need an Accountant to do my Tax Return? 5 Reasons Not to DIY Your Tax Return For Your Small Business It’s Tax Season and the question I'm asked the most is: Do I need an Accountant to do my Tax Return? And even after over 22 years of working in the accounting industry, my answer remains the same - Yes, You Do! Why? Well… As a small business owner, you may be used to taking the DIY approach. After all, you’re most likely a marketer, financial director, HR manager and payroll administrator, to name but a...

Read More

Do I Need an Accountant for My Small Business? 3 Signs That You Need An Accountant for Your Business

Do I need an Accountant for my Small Business? 3 Signs That You Need An Accountant for Your Business There’s so much to think about when running a small business and you can’t do it alone forever. For one thing, handling the financial side of your business is a full time job in itself and you really can’t afford to take your foot off of the gas for any length of time. Without external help, it’s all too easy to lose control of your finances and this can prove disastrous. Many small businesses put off hiring an accountant...

Read More

The Most Dangerous Accounting Mistakes For Your Small Business

The Most Dangerous Accounting Mistakes For Your Small Business Starting your own business is an amazing thing to do but it’s also notoriously risky. There’s a lot to think about when you first start out on your own and it can be tempting to put accounting on the back burner, but that would be a huge mistake. Good accounting is crucial to the financial health of your business and mistakes can be devastating, especially in the early days. It’s important to know which mistakes to avoid to ensure that your small business is around for years to come. ...

Read More

How a Business Credit Card Can Help You to Better Manage Cash Flow

How a Business Credit Card Can Help You to Better Manage Cash Flow As we edge ever closer towards a completely cashless society, credit cards are becoming more and more necessary. Business credit cards are also enormously helpful for bookkeeping, payment protection, and emergency funds. So long as you manage your account well, a business credit card can really help you to manage your cash flow more effectively and smooth out any bumps along the way. Here are the top reasons to get a credit card for your small business. Separate Business and Personal Transactions It’s important to...

Read More

Changing Accountants: How to Choose the Right Accountant to Invest In

Changing Accountants: How to Choose the Right Accountant to Invest In There are many reasons you might want to change your accountant, but whatever your reasons are, choosing a great accountant is one of the best investments you can make for your business. A quality accountant can do much more than save you money on your tax bill - although of course, that’s important too. A professional accountant is a strategic business partner who can provide shrewd insight into your financial situation and offer valuable advice that will guide you towards success. They will serve as an...

Read More